Top Pick's

Editor's Choice

Experience the Ultimate Canada & Alaska Adventure: Rocky Mountaineer Train Luxury Travel

1025a.jpgMountain winds call and glaciers gleam on this journey through Canada and Alaska, by sea and by rail. Revel in the rugged Canadian Rockies and seek diverse wildlife on an evening safari through Banff National Park. Walk across ancient glaciers at the Columbia Icefield, reflect on nature’s photogenic grandeur at Lake Louise, and spend one exquisite night at the Fairmont Chateau.1025b.jpgThen navigate untamed wilderness aboard the Rocky Mountaineer en route to Vancouver. There, you’ll embark on a voyage like no other as you set sail through Alaska’s Inside Passage across seven nights aboard Holland America Line’s Koningsdam. With a range of exquisite facilities at your fingertips, gourmet dining, and a blissful spa, you’re set to enjoy the spellbinding beauty of the Inside Passage’s glacier-cut fjords and lush temperate rainforests, along with the region’s rich Indigenous heritage and frontier history.1025c.jpg***Rail & Sail Upgrades: Select the Superior Upgrade at checkout for an Oceanview Stateroom aboard your Alaska HAL cruise, or select the Deluxe Upgrade for the heightened indulgence of your private furnished balcony in a Verandah Stateroom. Both upgrades additionally include GoldLeaf Service aboard the Rocky Mountaineer: enjoy panoramic views from a stunning bi-level glass-dome coach, take in even more details on an exclusive viewing platform, then sit down for gourmet meals in style in your carriage’s white-cloth dining section as you traverse a landscape of peerless grandeur.1025d.jpgDon’t miss this extraordinary rail and sail adventure – book now for the ultimate Canada & Alaska experience!

How to Save Money on Taxes: Tips for Individuals and Businesses

Saving money on taxes is a priority for many individuals and businesses. Whether you're a small business owner, a freelancer, or someone simply looking to reduce your tax liability, there are various strategies you can implement to keep more of your hard-earned money. In this article, we’ll explore several tips for both individuals and businesses to help minimize tax payments.1113a.jpgTax Deductions for IndividualsTax deductions are a great way to lower your taxable income and save money on taxes. Some common deductions include:Mortgage Interest: Homeowners can deduct mortgage interest payments, which can provide significant savings, especially in the early years of the loan.Student Loan Interest: If you're paying off student loans, you may be eligible to deduct up to $2,500 of the interest paid each year.Medical Expenses: If your medical expenses exceed 7.5% of your adjusted gross income (AGI), you may qualify for a deduction.Charitable Contributions: Donations to qualified charities can be deducted, which can reduce your tax liability.***Tax Credits for IndividualsTax credits directly reduce the amount of tax you owe, making them even more valuable than deductions. Some key tax credits include:Earned Income Tax Credit (EITC): This credit is available to low-to-moderate-income individuals and families and can significantly reduce tax bills.Child Tax Credit: If you have dependent children under the age of 17, you may be eligible for a tax credit of up to $2,000 per child.Education Credits: Credits like the American Opportunity Credit and Lifetime Learning Credit can help reduce the cost of higher education.***Tax Strategies for BusinessesBusinesses also have a variety of tax-saving opportunities. Here are some strategies that can help businesses reduce their tax burdens:Maximize Business Deductions: Businesses can deduct operating expenses such as office supplies, equipment, business travel, and employee wages. Keeping track of these expenses throughout the year can lead to significant savings.Section 179 Deduction: This allows businesses to deduct the full purchase price of qualifying equipment and software in the year it is bought, rather than depreciating it over several years.Retirement Plans: Contributing to retirement plans such as a 401(k) or a Simplified Employee Pension (SEP) IRA can reduce taxable income, both for employees and business owners.Qualified Business Income Deduction: For pass-through businesses (e.g., LLCs and S Corps), the QBI deduction allows for up to a 20% deduction on business income.1113b.jpg***How to Minimize Taxes on Investment IncomeInvestment income, such as interest, dividends, and capital gains, is often taxed at a higher rate than earned income. Here are some ways to minimize the tax burden on your investments:Long-Term Capital Gains: Holding investments for over a year before selling them can lower the tax rate on capital gains, as long-term gains are taxed at a lower rate than short-term gains.Tax-Efficient Investments: Investing in tax-advantaged accounts such as Roth IRAs, 401(k)s, or Health Savings Accounts (HSAs) can reduce your taxable income. Additionally, certain types of bonds, such as municipal bonds, are tax-exempt.Offset Capital Gains with Losses: If you sell an investment at a loss, you can use that loss to offset gains from other investments, reducing your overall taxable income. This is known as tax-loss harvesting.***Tax Saving Tips for Freelancers and ContractorsFreelancers and contractors face unique tax challenges. Here are some strategies to help save money on taxes:Track Business Expenses: As a freelancer, you can deduct a wide range of business expenses such as home office costs, software subscriptions, and travel. Keeping detailed records is crucial for maximizing these deductions.Pay Estimated Taxes: Freelancers and contractors typically don’t have taxes withheld from their income, so it’s important to pay estimated taxes quarterly to avoid penalties.Set Up a Retirement Account: Freelancers can set up tax-advantaged retirement accounts such as a Solo 401(k) or SEP IRA, which not only helps save for retirement but also lowers taxable income.***How to Save on State and Local TaxesIn addition to federal taxes, you may also face state and local taxes. Here are some strategies to reduce your state and local tax burden:Relocate to a Low-Tax State: Some states have no income tax, such as Florida and Texas. Moving to one of these states can potentially save you thousands of dollars each year.Use Tax Credits: Many states offer tax credits for things like education, renewable energy improvements, and charitable donations. Check with your state’s tax authority to see what credits are available.Consider State-Specific Retirement Accounts: Some states offer tax-advantaged retirement accounts with higher contribution limits, which can help you save more on your state taxes.***The Importance of Tax PlanningEffective tax planning can significantly reduce your tax liability. It’s important to plan ahead by keeping track of your income, expenses, and deductions throughout the year. Working with a tax professional or financial advisor can help you take advantage of all available tax-saving opportunities and ensure that you’re prepared for tax season.***ConclusionSaving money on taxes requires strategic planning and an understanding of available tax benefits. Whether you're an individual, business owner, or freelancer, taking advantage of deductions, credits, and tax-advantaged accounts can result in substantial savings. Stay informed about tax laws and consult with a professional to ensure you're minimizing your tax liability and keeping more of your money.

Emergency Funds: Why They’re Essential and How to Build One

An emergency fund is a crucial aspect of financial planning, providing a safety net for unexpected situations such as medical emergencies, car repairs, or sudden job loss. Having a well-established emergency fund can reduce stress and prevent you from going into debt when life’s unexpected events occur. In this article, we’ll explore why emergency funds are essential and how you can start building one today.1115a.jpgWhy You Need an Emergency FundAn emergency fund serves as a financial buffer to cover unexpected expenses, ensuring that you’re not forced to rely on credit cards or loans in times of need. Here are some key reasons why having an emergency fund is important:Financial Security: An emergency fund provides a sense of security knowing you have money set aside for unforeseen events.Avoiding Debt: Without an emergency fund, you may resort to credit cards or loans, which can lead to high-interest debt.Peace of Mind: Knowing you’re financially prepared for emergencies reduces stress and allows you to focus on resolving the situation rather than worrying about finances.***How Much Should You Save for an Emergency Fund?The amount you should aim to save in your emergency fund depends on your lifestyle, expenses, and individual needs. A general rule of thumb is to save at least three to six months' worth of living expenses. However, you may need more depending on factors like job stability, family size, or the potential for medical emergencies.Factors to consider when determining how much to save include:Your Monthly Expenses: Calculate your essential monthly expenses, such as rent, utilities, groceries, and transportation.Job Stability: If you work in a field with high job turnover or uncertainty, you may want to save more to account for potential unemployment.Health Factors: If you have a family history of health issues or live in a location with high healthcare costs, you may need a larger emergency fund.***Where to Keep Your Emergency FundYour emergency fund should be kept in an easily accessible, low-risk account. Consider the following options for storing your emergency savings:High-Yield Savings Accounts: These accounts offer higher interest rates than regular savings accounts, allowing your emergency fund to grow while remaining liquid.Money Market Accounts: Money market accounts are another safe option that offers competitive interest rates and easy access to your funds.Certificates of Deposit (CDs): Although not as liquid as savings or money market accounts, short-term CDs can offer higher interest rates for your emergency fund if you don’t need immediate access to the money.1115b.jpg***Steps to Build Your Emergency FundBuilding an emergency fund doesn’t happen overnight, but with discipline and a strategic approach, you can steadily grow your savings. Here are the steps to get started:Start Small: Begin by setting a realistic goal, such as saving $500 or $1,000. Once you’ve reached this initial milestone, work towards three to six months of expenses.Automate Your Savings: Set up automatic transfers from your checking account to your emergency fund each payday. This makes saving easier and ensures you stay consistent.Cut Back on Unnecessary Expenses: Review your budget and identify areas where you can reduce spending, such as dining out or subscription services. Use the extra money to build your emergency fund.Use Windfalls: If you receive a tax refund, work bonus, or other unexpected income, consider putting a portion of it toward your emergency savings.***When to Use Your Emergency FundYour emergency fund should be reserved for true emergencies. While it may be tempting to dip into the fund for non-urgent expenses, it’s important to save it for unexpected events like:Job Loss: If you lose your job or experience a reduction in income, your emergency fund will help you cover living expenses while you search for new work.Medical Emergencies: Health issues can arise unexpectedly, and having an emergency fund ensures you can cover medical bills without going into debt.Car Repairs: If your car breaks down or requires urgent repairs, your emergency fund will allow you to address the issue without relying on credit cards.***Tips for Maintaining Your Emergency FundOnce your emergency fund is established, it’s important to maintain it. Here are some tips to ensure your fund stays intact:Avoid Temptation: Resist the urge to use your emergency fund for non-emergencies, and make sure to only use it for its intended purpose.Replenish After Use: If you tap into your emergency fund, make sure to replenish it as soon as possible to ensure it’s available for the next unexpected situation.Review Your Fund Periodically: As your expenses change, review your emergency fund to ensure it’s still sufficient for your needs.***ConclusionBuilding an emergency fund is an essential part of financial planning. It provides peace of mind and financial security during uncertain times. By starting small, automating your savings, and using your emergency fund responsibly, you can protect yourself from financial stress and avoid falling into debt. Whether you’re just starting or looking to grow your savings, it’s never too late to begin building your emergency fund.

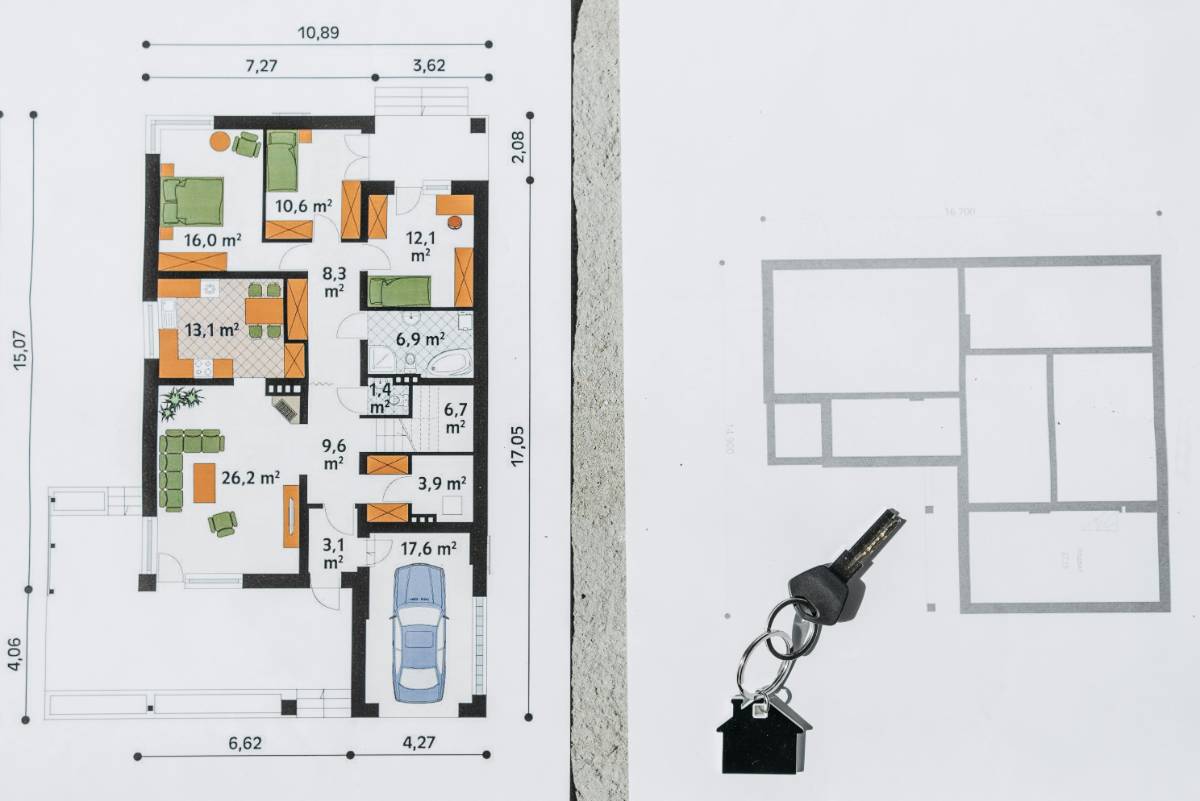

Top Renovation Tips to Increase Your Home’s Value

Home renovation is one of the most effective ways to increase the value of your property. Whether you're planning to sell your home or just want to enhance its appeal, certain renovations can provide a significant return on investment. In this article, we share some top renovation tips to help you increase your home's value and make it more attractive to potential buyers.1069a.jpgKitchen RenovationsThe kitchen is often considered the heart of the home, and renovating it can have a huge impact on your home's value. Whether you make minor upgrades or complete a full remodel, investing in your kitchen is a smart choice.Upgrade Appliances: Consider installing energy-efficient, modern appliances to attract eco-conscious buyers.Add Storage: Incorporating smart storage solutions like pull-out shelves or additional cabinets can make a big difference.Modernize Finishes: Updating countertops, backsplash, and cabinetry with trendy finishes can give your kitchen a fresh look.***Bathroom ImprovementsBathrooms are another area where improvements can boost your home's value. A modern, functional bathroom can make your home feel more luxurious and increase its marketability.Install New Fixtures: Upgrading faucets, lighting, and showerheads with high-end options can make the space feel more sophisticated.Enhance Functionality: Consider adding more storage or creating a spa-like atmosphere with features like a soaking tub or walk-in shower.Refresh Surfaces: Replacing worn-out tiles, vanities, and mirrors with sleek alternatives can transform your bathroom.***Curb Appeal EnhancementsFirst impressions matter, and the exterior of your home is the first thing potential buyers will see. Improving your curb appeal can make your home stand out and increase its perceived value.Landscaping: Planting flowers, trimming hedges, and maintaining a well-manicured lawn can create an inviting atmosphere.New Paint: A fresh coat of exterior paint in a neutral or modern color can instantly uplift the look of your home.Upgrade the Front Door: Replacing or painting your front door can give your home a welcoming feel.***Energy-Efficient UpgradesEnergy-efficient home improvements not only help reduce utility costs but also appeal to environmentally conscious buyers. These upgrades can be a great selling point and can boost your home's value.Insulate Properly: Adding insulation to your attic, walls, and floors can improve energy efficiency and comfort.Install Energy-Efficient Windows: Replacing old windows with energy-efficient ones can help reduce heating and cooling costs.Upgrade HVAC Systems: Installing a modern, energy-efficient heating and cooling system can make your home more attractive to buyers.1069b.jpg***Open Concept LayoutOpen-concept floor plans are highly desirable, especially in modern homes. If your home has small, closed-off rooms, consider knocking down walls to create a more open and spacious layout.Remove Barriers: Open up your kitchen to the living room or dining area to create a flow that is more appealing.Add Functional Spaces: Use the extra space to create multifunctional rooms, such as a home office or a playroom.***Basement and Attic RenovationsIf you have an unfinished basement or attic, consider renovating these spaces to add usable square footage to your home. Finished basements and attics can be transformed into bedrooms, offices, or even entertainment spaces.Create Additional Living Areas: Finishing these spaces provides additional living areas, which can be a major selling point.Add a Bathroom: If possible, adding a bathroom to the basement or attic can significantly increase the value of the space.***Smart Home TechnologyIncorporating smart home technology into your renovation can make your home more modern and appealing to tech-savvy buyers. Adding smart devices can also increase convenience, security, and energy efficiency.Install Smart Thermostats: A smart thermostat allows buyers to control the home's temperature remotely, enhancing comfort and energy savings.Add Smart Lighting: Smart lighting systems can be controlled through apps, offering convenience and energy savings.Upgrade Security: Installing smart security cameras, doorbell cameras, and smart locks can increase the perceived safety and value of your home.***ConclusionRenovating your home is an investment that can pay off in increased value and marketability. By focusing on high-impact areas like the kitchen, bathroom, and curb appeal, you can make your home more attractive to potential buyers. Additionally, energy-efficient upgrades and smart home technology can add long-term value, making your home a more appealing option in a competitive real estate market.

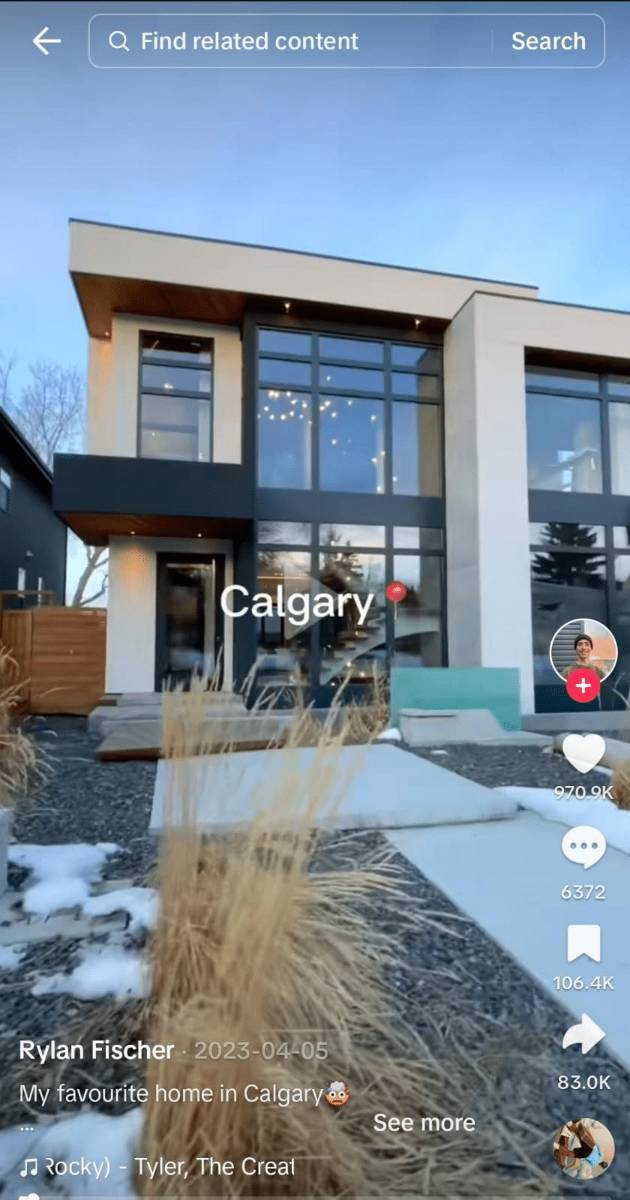

How to Avoid Common Mistakes in Real Estate Transactions

Real estate transactions can be complex and are often one of the most significant financial decisions individuals make. Avoiding common mistakes can save time, money, and stress. Here’s a guide to help you navigate the process smoothly and make informed choices.1146a.jpgResearch the Market ThoroughlyOne of the biggest mistakes buyers and sellers make is jumping into the market without sufficient research. Before making a purchase or setting a listing price, take the time to understand local market trends, property values, and neighborhood dynamics. Knowing the market allows you to make better-informed decisions and avoid overpaying or underselling.***Get Pre-Approved for FinancingBuyers often overlook the importance of securing financing before starting the property search. A pre-approval not only gives you a clear budget but also strengthens your position in negotiations. Sellers are more likely to consider offers from pre-approved buyers, as it indicates financial readiness and reduces the risk of the deal falling through.***Work with a Qualified Real Estate AgentWhether you’re buying or selling, working with an experienced real estate agent can help avoid pitfalls. A good agent brings market knowledge, negotiation skills, and guidance through the paperwork. Be sure to choose an agent with a track record in the area and one who understands your goals.1146b.jpg***Understand the Full Costs InvolvedMany first-time buyers and sellers underestimate the costs associated with real estate transactions. Buyers should factor in expenses like closing costs, inspection fees, property taxes, and homeowners’ association fees. Sellers may need to consider costs for repairs, staging, and agent commissions. Budgeting for these costs in advance can help prevent unpleasant surprises.***Don’t Skip the Home InspectionA thorough home inspection is essential for identifying potential issues with the property. Skipping this step can lead to unexpected repair costs or safety hazards. Even in a competitive market, it’s wise to invest in an inspection to ensure the property is in good condition and worth the price.***Be Cautious with ContingenciesContingencies are conditions that must be met for a sale to proceed, such as securing financing or a satisfactory home inspection. While waiving contingencies may make your offer more attractive in a competitive market, it also exposes you to more risk. Always weigh the potential consequences before waiving any contingencies.***Keep Emotions in CheckReal estate transactions can be emotional, especially when buying a home to live in. However, letting emotions drive your decisions may lead to overpaying or overlooking issues. Keep a clear set of criteria in mind, and stay objective to ensure you make financially sound decisions.***ConclusionAvoiding common mistakes in real estate transactions requires preparation, research, and careful decision-making. By understanding the market, securing financing, working with professionals, and staying mindful of costs, you can navigate the real estate process more confidently and achieve a successful outcome.

The Best Hidden Gems Around the World for Solo Travelers

Solo travel offers a unique opportunity to explore new places at your own pace, and there’s nothing quite like discovering hidden gems that are off the beaten path. Here are some of the best hidden destinations for solo travelers in 2024, perfect for those looking for adventure, peace, and unforgettable experiences.1075a.jpg1. BhutanNestled in the Himalayas, Bhutan is a peaceful country known for its stunning landscapes, monasteries, and focus on happiness. Solo travelers can explore the serene valleys, hike to the Tiger’s Nest monastery, and enjoy the warm hospitality of the Bhutanese people. The country’s focus on sustainable tourism makes it ideal for eco-conscious travelers.***2. Faroe Islands, DenmarkThe Faroe Islands, a group of rugged, windswept islands in the North Atlantic, are a hidden gem for solo adventurers. Known for their dramatic landscapes, remote villages, and friendly locals, the Faroe Islands offer countless opportunities for hiking, birdwatching, and connecting with nature.***3. MadagascarFor those seeking wildlife and adventure, Madagascar is a dream destination. With its unique flora and fauna, such as lemurs and baobab trees, this island off the coast of East Africa offers a surreal experience. Solo travelers can explore the island's national parks, go whale watching, or simply unwind on pristine beaches.***4. Tbilisi, GeorgiaTbilisi, the capital of Georgia, is a charming city that boasts a mix of ancient architecture and modern flair. Solo travelers can wander through its cobblestone streets, sample delicious Georgian cuisine, and explore the surrounding wine regions. Georgia is an affordable and friendly destination that makes solo travel easy and rewarding.***5. UzbekistanKnown for its incredible historical sites along the Silk Road, Uzbekistan is a hidden gem for solo travelers interested in history and culture. Cities like Samarkand, Bukhara, and Khiva are home to stunning Islamic architecture and ancient monuments. Uzbekistan offers a unique travel experience without the crowds found in more traditional destinations.1075b.jpg***6. Isle of Skye, ScotlandThe Isle of Skye in Scotland offers breathtaking views of rugged coastlines, rolling hills, and ancient castles. It’s a great destination for hiking, photography, and experiencing Scotland's natural beauty. Solo travelers can enjoy the solitude and explore the island’s dramatic landscapes at their own pace.***7. AlbaniaAlbania is an increasingly popular destination for solo travelers looking for a mix of adventure, culture, and relaxation. From the stunning Albanian Riviera to the ancient ruins of Butrint, Albania offers a range of activities in a less touristy setting. Solo travelers can explore the country’s beaches, mountains, and charming towns with ease.***8. NepalFor those seeking adventure, Nepal is a hidden gem in the Himalayas. Whether you're trekking to Everest Base Camp or exploring the temples in Kathmandu, Nepal offers both challenging outdoor adventures and opportunities for spiritual reflection. Solo travelers can easily find trekking groups or enjoy a more solitary experience in the stunning mountains.***9. MontenegroMontenegro is an Adriatic gem that offers stunning beaches, crystal-clear waters, and charming medieval towns. Solo travelers can explore the Bay of Kotor, the historic town of Budva, and hike the rugged mountains, all while enjoying the peaceful atmosphere away from the crowds.***10. Patagonia, Chile & ArgentinaPatagonia, located at the southern tip of South America, is a paradise for nature lovers and solo adventurers. From the towering peaks of Torres del Paine to the glaciers of Los Glaciares National Park, Patagonia offers some of the most awe-inspiring landscapes in the world. Solo travelers can enjoy hiking, wildlife spotting, and the stunning wilderness.***ConclusionSolo travel opens the door to discovering lesser-known destinations that offer rich experiences and personal growth. Whether you're looking for an adventurous trek, a cultural exploration, or a peaceful retreat, these hidden gems around the world are perfect for solo travelers seeking something off the beaten path.

Must Read

Commercial Real Estate vs. Residential: What’s Right for You?

How to Finance Your Real Estate Purchase

Real Estate Market Forecast for the Next Five Years

What Makes a Neighborhood Ideal for Investment?

The Role of Real Estate Agents in Property Transactions

Understanding Real Estate Taxes and How They Impact You

How to Sell Your Home Quickly and Efficiently

First-Time Homebuyer Tips for Success

Luxury Homes: A Growing Trend in Real Estate

Real Estate Investment Strategies for Beginners

Understanding Property Valuation and Appraisal

Top Real Estate Trends to Watch in 2024

The Importance of Location in Real Estate Buying

How to Choose the Perfect Property for Investment

Exploring the Future of Real Estate Investment

The Role of Virtual Tours in Modern Real Estate Marketing

Exploring the Shift Towards Mixed-Use Real Estate Developments

Challenges Facing the Real Estate Industry in Urban Areas

Top Renovation Tips to Increase Your Home’s Value

Benefits of Investing in Commercial Real Estate

The Role of Artificial Intelligence in Real Estate

Navigating the Real Estate Market: Tips for First-Time Homebuyers

Top Emerging Markets for Real Estate Investors

Understanding the Impact of Interest Rates on Real Estate Market

Real Estate Investment Strategies for Beginners

Exploring Sustainable Real Estate Development

How Technology is Shaping the Real Estate Industry

Luxury Living: The Rise of High-End Real Estate

The Future of Real Estate: Trends to Watch in 2024

Unbelievable Perks: 10 Indian Luxury Hotels Where You Get a Free Stay Each Year!

7 Tips for Posting On Social Media as a Real Estate Professional

Top 7 Real Estate Social Networks You Need in 2024

Greece Luxury Homes That Will Leave You Speechless—See Inside!

Searching for Your New Home? Here’s Where – and Why – New Homes Sell Fast in London

Portland Place

A Rare Gem of Luxury Living in London

5 Cheapest Rental Properties in London

Coronation Houses: 10 Homes to Make Your Castle

10 Beautiful Victorian Homes for Sale in London

London's Georgian Houses: 10 Historic Homes

Budget Friendly Places in London to Live, Love & Laugh

The Top Houses in London for Sale! Are You Ready to Buy or Invest?

With Demand on the Rise, Is Your London Rental Prepared to Meet the Surge?

Tips for Planning a Multi-Country Vacation

How to Capture Stunning Travel Photos

Cultural Etiquette to Know Before Traveling Abroad

Essential Tips for Traveling with Pets

How to Create the Perfect Travel Itinerary

Exploring National Parks: Nature’s Greatest Adventures

Top Destinations for Luxury Travel Experiences

How to Stay Safe While Traveling Abroad

The Ultimate Backpacking Guide for Beginners

Winter Wonderland: Best Destinations for Snow Lovers

How to Maximize Your Frequent Flyer Miles

Top Travel Apps You Should Download Before Your Trip

Unforgettable Beach Destinations for Relaxation

How to Travel with Kids: Tips for a Smooth Journey

A Guide to the Most Scenic Road Trips

How to Find the Best Travel Deals and Discounts

Essential Travel Tips for First-Time Travelers

Exploring the Best Culinary Destinations Worldwide

Must-Visit Destinations for Adventure Seekers

How to Pack Light for Any Destination

Tips for Sustainable and Eco-Friendly Travel

Top Travel Destinations to Visit in 2024

The Ultimate Guide to Solo Travel

How to Travel on a Budget and Still Enjoy Luxury

Exploring Hidden Gems: Unique Travel Destinations Around the World

The Future of Travel: How Technology is Transforming the Industry

Foodie Travel: The Best Culinary Destinations to Explore

Top Wellness Retreats Around the World for Relaxation and Rejuvenation

How to Plan a Perfect Road Trip: Tips for a Memorable Adventure

Luxury Train Journeys: Discover the World in Style

Must-Have Travel Apps for a Smooth Journey

The Rise of Digital Nomads: Working and Traveling Simultaneously

Cultural Immersion: How to Truly Experience Local Traditions While Traveling

Family-Friendly Travel: The Best Destinations for All Ages

Exploring Remote Islands: The World’s Most Secluded Destinations

How to Travel on a Budget: Tips and Tricks for Saving Money

Top Adventure Travel Destinations for Thrill Seekers

The Ultimate Packing Guide for Every Type of Traveler

A Guide to Luxury Travel: Experience the Best of the Best

The Best Hidden Gems Around the World for Solo Travelers

How to Travel Sustainably: Tips for Eco-Conscious Travelers

Top 10 Destinations to Visit in 2024

Discover the Best of the USA Northeast: Explore New York City, Washington D.C., & Don't miss Niagara Falls!

Set Sail for Sunset Laughs and Local Bites: Waikiki's Captain’s Cruise with Tasty Delights You Can't-Miss!

Unlock the Heart of Southern USA: Explore Graceland, the Country Music Hall of Fame, and More Legendary Destinations!

Experience the Ultimate Canada & Alaska Adventure: Rocky Mountaineer Train Luxury Travel

Step Aboard the World’s Most Luxurious Cruises – An Exclusive Getaway Awaits!

Exclusive Water Adventure You Should Not Miss in Australia

Full-Day Moore Reef Thrills: Snorkeling, Waterslide, & Underwater Observatory Adventure!

Island Meets Mountain: The Ultimate Australian Getaway You Should Not Miss!

Don’t Miss These Australia's Most Exclusive Destinations Visit Before They Vanish

The Most Epic Submarine Tour You Can’t Miss in Aruba – Journey to the Ocean’s Depths!

Relax and Handle Business: Experience the Perfect Work Trip to Japan, Rome, and Paris!

John Hancock Medical Travel Insurance Could Save You Dollars! Travel Abroad With This Insurance That Covers All

The Next Generation of Bollywood Actresses Ready to Take Over with Their Amazing Curves!

Don't Miss These Dubai’s Top Models and Why They’re Hotter Than any American Models!

Want to Travel to Dubai on a Budget? Just ₹15K Gets You There – Book Now

Essential Fashion Tips for Every Season

Fashion on a Budget: Stylish Tips for Saving

How to Style Athleisure for Everyday Wear

Choosing Colors That Flatter Your Skin Tone

How to Master the Art of Effortless Style

Office Fashion: Balancing Style and Professionalism

Fashion Icons Through the Decades

How to Choose the Perfect Denim Fit

Top Styling Tips for Petite Women

Vintage Fashion: Bringing Back Classic Styles

How to Mix Patterns Like a Pro

Must-Have Shoes to Complete Every Outfit

The Art of Layering: Tips for Every Season

How to Transition Your Wardrobe from Day to Night

Fashion Mistakes to Avoid for a Timeless Look

How to Dress Up Basics for Any Occasion

A Guide to Choosing the Perfect Accessories

Men’s Fashion: Key Trends for the Modern Gentleman

How to Style Statement Pieces with Confidence

Essential Wardrobe Staples Every Woman Needs

Sustainable Fashion: Tips for an Eco-Friendly Wardrobe

How to Dress for Your Body Type

Top Fashion Trends to Watch in 2024

The Ultimate Guide to Building a Capsule Wardrobe

The Evolution of Athleisure: From Gym Wear to Street Wear

Celebrity Fashion: The Best Red Carpet Moments of All Time

Street Style: The Best Fashion Looks from Around the World

How Social Media is Shaping the Fashion Industry

Must-Have Accessories to Elevate Your Outfit

The Rise of Gender-Neutral Fashion: Breaking Traditional Boundaries

How to Style Your Wardrobe for Every Season

Sustainable Fashion: How to Build an Eco-Friendly Wardrobe

The Top Fashion Trends to Watch in 2024

Can You Handle the Cringe? The Most Bizarre Fashion Trends Coming in 2025!

The Gym Shirt That’s Breaking the Internet: Why Everyone's Ditching Regular Workout Gear

The Hidden World of Bamboo Pajamas: How Sustainable Fashion Is Becoming a Billion-Dollar Industry

Sustainable Shopping Guide: Top UK Brands for Eco-Friendly Fashion

How Oscar Piastri Went From Karting Kid to F1 Superstar Overnight!

Curvy Confidence: The Plus-Size Clothing Hacks Everyone Should Know

Love Your Curves: Must-Have Plus-Size Pieces to Elevate Your Style!

Behind the Scenes: 5 Surprising Stories from the U.S. Entertainment Industry That Will Leave You Speechless!

Fashion Time Travel: 6 Vintage Trends Making a Stunning Comeback in the U.S.!

Steal the Spotlight: The 7 Fashion Trends That Will Dominate the U.S. This Fall!

How to Plan for Big Financial Milestones in Your Life

How Economic Trends Affect Personal Finances and Investments

The Pros and Cons of Investing in Gold and Precious Metals

Smart Ways to Save for Your Child’s Education

How to Create Multiple Streams of Income

Estate Planning: Securing Your Assets for the Next Generation

Understanding and Managing Risk in Your Investment Portfolio

How to Set and Achieve Financial Goals Effectively

Financial Mistakes to Avoid in Your 20s, 30s, and 40s

The Basics of Passive Income: How to Make Money Work for You

Emergency Funds: Why They’re Essential and How to Build One

The Rise of Fintech: How Technology is Changing Finance

How to Save Money on Taxes: Tips for Individuals and Businesses

Real Estate vs. Stocks: Which Investment is Better?

Understanding the Stock Market: A Guide for New Investors

Budgeting for Beginners: How to Start and Stick to It

The Impact of Inflation on Personal Finances

How to Build and Improve Your Credit Score

The Role of Financial Advisors in Wealth Management

Retirement Planning: Steps to Secure Your Future

Understanding Cryptocurrency: Is it a Good Investment?

Personal Finance 101: Essential Skills for Managing Money

The Importance of Diversifying Your Investment Portfolio

How to Build Wealth: Investing for Beginners

Top Financial Planning Tips for 2024

How to Save on Health Insurance Costs: Tips for Families and Individuals

Personal Loan vs. Credit Card: Which is Better for Debt Consolidation?

Car Insurance in the US: What You Need to Know Before You Buy

Top 5 US Banks with the Best Customer Service in 2024

Exploring the Best Loan Options for First-Time Homebuyers

How to Improve Your Credit Score: Essential Tips for US Borrowers

5 Key Differences Between Personal and Business Loans

Understanding the US Banking System: How It Works and Why It Matters

A Complete Guide to Choosing the Right Insurance Policy for Your Needs

Top 10 Financial Tips for Building Wealth in the US

Buy Bitcoin with Ease: The Ultimate Guide to Using Prepaid Cards!

How to Turn $100 Into $10,000 With This Little-Known Investment Strategy

How I Paid Off $50,000 Debt in Just 12 Months – You Can Too!

The 3 Stocks Every Beginner Should Buy in 2024!

Why You Should Stop Saving and Start Investing Today!

5 Secret Credit Card Tricks Banks Don’t Want You to Know

How to Become a Millionaire with These Simple Investing Tips!

How to Get an Instant Loan Up to 10 Lakhs Without CIBIL Score and Online Verification